Dubai Islamic Bank Car Loan Calculator 2020

Dubai islamic car loan min salary 3000 aed onwards profit rates flat 2 75 onwards check eligibility max loan amount 1500000 aed down payment 20 apply for car loan.

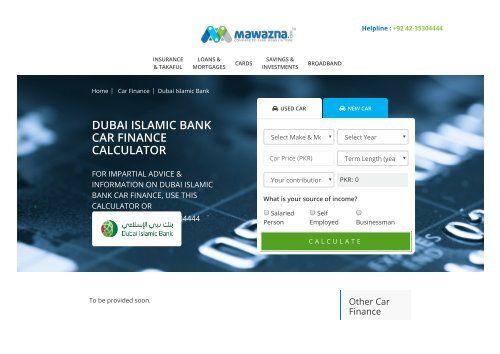

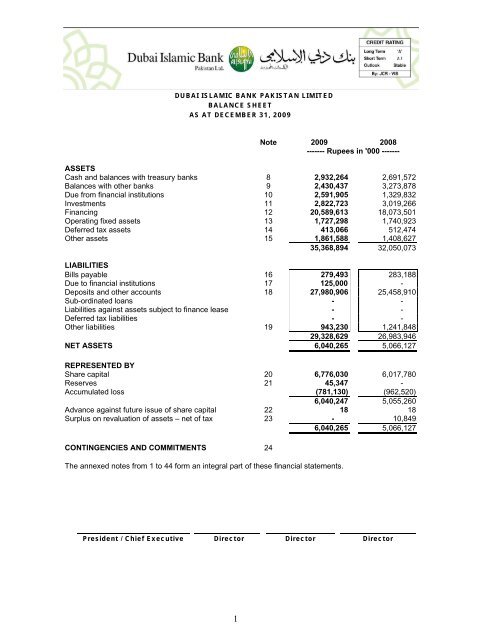

Dubai islamic bank car loan calculator 2020. Dubai islamic bank shareholders approve 35 dividend as net profit rises to aed 5 1 billion. Dubai islamic bank 1st quarter 2020 group financial results 16 march 2020. The user is asked to input required car type new old car make car model user s city loan tenure and initial down payment. Whether you re buying your first car or investing in a fleet of vehicles our wide range of finance plans and payment options suit every personal and commercial need.

United arab emirates. Your bank may file a report with the uae credit rating agency which may impact your ability to borrow from uae. High finance amount and low minimum salary requirement is there for given finance finance can be provided for new as well as used cars maximum repayment period is of 60 months approval is quick documentation is simple minimum salary requirement is low finance up to 80 of the car price dubai islamic bank provides option of financing. Since the world has been progressing in different ways new businesses and products are being launched just like car loan calculator the need for going from place to place is essential and the acquisition of conveyance is much needed for everyone whether you are a businessman or a salaried employee but the major problem any buyer usually comes across with is the lack of.

Our home finance auto finance and personal finance calculator tools allow you to input your information and receive an estimated installment plan so you can choose the right finance solution for you. Uae car loan calculator. Using musharaka cum ijara model to finance your car steer yourself towards peace of mind and fulfillment of your desire. The calculator will output total.

Dubai islamic auto finance offers a world class auto finance facility that enables you to get a car quickly conveniently and in a fully sharia compliant manner.