Dubai Islamic Bank Car Loan Early Settlement

Processing fee is aed 2500.

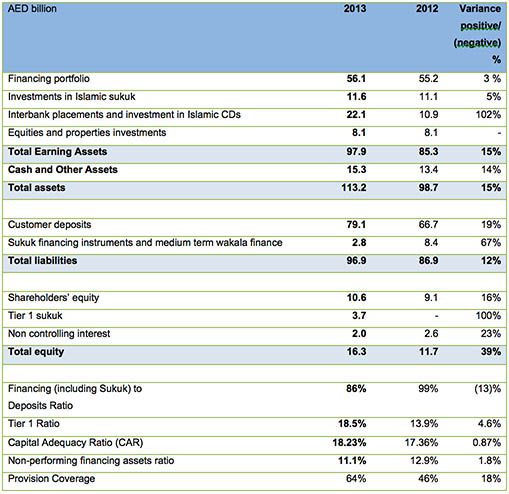

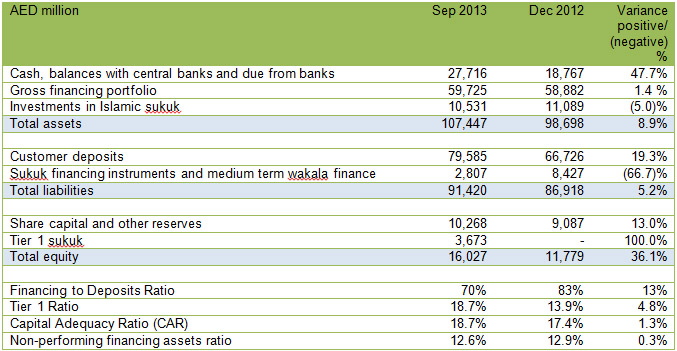

Dubai islamic bank car loan early settlement. We have a vehicle loan with emirates islamic bank eib. Dubai islamic bank 1st quarter 2020 group financial results 16 march 2020 dubai islamic bank shareholders approve 35 dividend as net profit rises to aed 5 1 billion. In the case of dubai islamic bank it depends on the type of loan for car loan the early settlement charges are 1 on the remaining balance same for personal loan and for home finance there are no charges. Dubai islamic bank 1st quarter 2020 group financial results 16 march 2020 dubai islamic bank shareholders approve 35 dividend as net profit rises to aed 5 1 billion.

The bank authorised collections team gave us a final amount of dh24 000 as a full and final settlement. Maximum loan amount is aed 1 500 000 that dubai islamic bank can provide. Dubai islamic bank 1st quarter 2020 group financial results 16 march 2020 dubai islamic bank shareholders approve 35 dividend as net profit rises to aed 5 1 billion. Compare car loans in uae to find the best auto finance for you.

Most banks in the uae collect a certain fee which comes under different names like early redemption early settlement or a pre payment fee. Dubai islamic auto finance offers a world class auto finance facility that enables you to get a car quickly conveniently and in a fully sharia compliant manner. About 20 down payment is required for this finance. Early settlement fee is 1 of the finance amount.

If you want more information and in details you can refer to compare home loans interest rates in dubai uae. Using musharaka cum ijara model to finance your car steer yourself towards peace of mind and fulfillment of your desire.