Odisha Gramya Bank Withdrawal Form Fill Up

Apply for personal loan online low interest rate quick processing flexible repayment ogb eligibility calculator required document purpos ogb personal loan faqs contact details ogb personal loan emi calculator.

Odisha gramya bank withdrawal form fill up. The fund transfer happens instantly without any delay. So ogb customers can send money to any other bank through imps by filling duly signed imps remittance form at their respective home ogb branch. Savings bank account can also be opened by a minor jointly with natural guardian or with mother as the guardian status. Please visit your nearest ogb branch for opening of recurring deposit.

Imps inward service is available 24x7x365 throughout the year including sundays and any. Recurring deposit allows you to build up a sizable capital over a period in a regular systematic and safe way. Odisha gramya bank is registered with pfrda as aggregators for the purpose of sourcing and processing apy accounts. Sometimes you may require changing your registered mobile number due to any.

Odisha gramya bank personal loan odisha gramya bank personal loan ogb personal loan interest rate at updated on 09 jun 2020. Call to number 8448290045 from your registered mobile and get savings bank account balance message instantly. Known as minor s account. Ogb rupay cards can be used at all banks atms pos and on line payments.

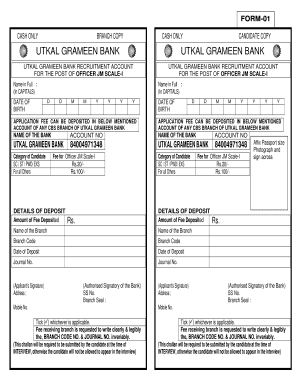

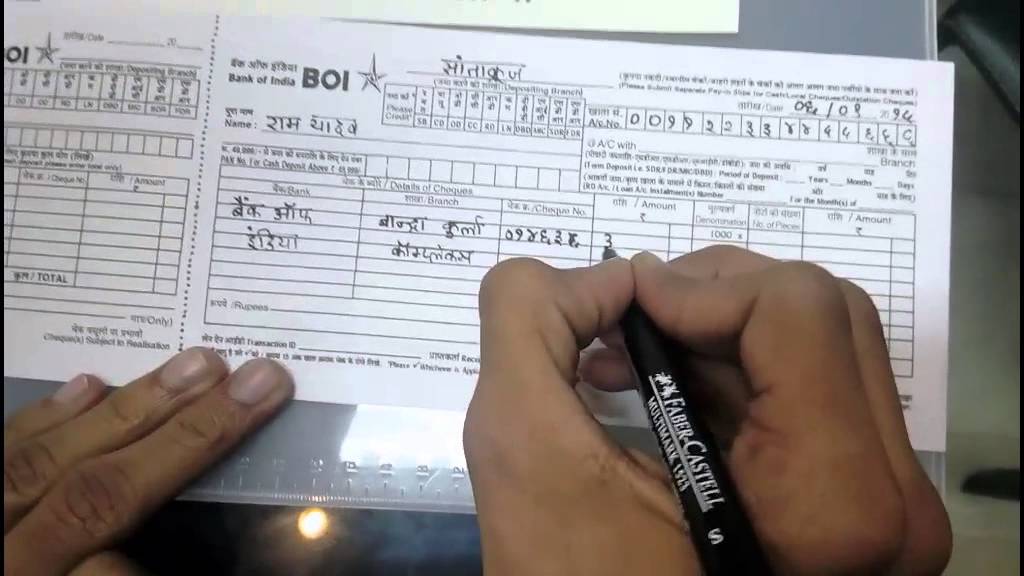

Savings bank accounts can be opened for eligible person persons and certain organizations agencies as advised by reserve bank of india rbi from time to time. Update change your registered mobile number in odisha gramya bank. By submitting form 15g epf members can avoid tds when they are claiming a pf amount of 50000 rs or above in below 5 yrs of total service. Beneficiary has to fill the applicable form and submit along with his identity proof and address proof for withdrawal of the remittance amount.

The minimum deposit under the scheme is rs 1 lakh or multiples of rs 1 lakh which is automatically swept out from the related sb account for a period of 90 days keeping a minimum balance of rs 5 lacs in sb account. Presently branch channel is enabled for our bank. Now a days as all the banks are providing net banking and phone banking facilities for ease of transactions and for convenience of their customers it is a must to get registered your mobile number with your bank to avail benefits of online banking. No charges shall be collected from the beneficiary at the time of payment.