Setting Up A Bank Account Online For A Minor

Federal regulations and the deposit agreement and disclosures limit the number of the following types of withdrawals and transfers from a savings account to a total of six 6 each monthly statement cycle or each month for savings accounts with a quarterly statement cycle.

Setting up a bank account online for a minor. If your savings account enrolled in keep the change is converted to a checking account keep the change transfers will continue to be made into that account. Your child s online habits. 1 as a result you ll need to open the account with your name on it as well. Check state laws by calling your bank.

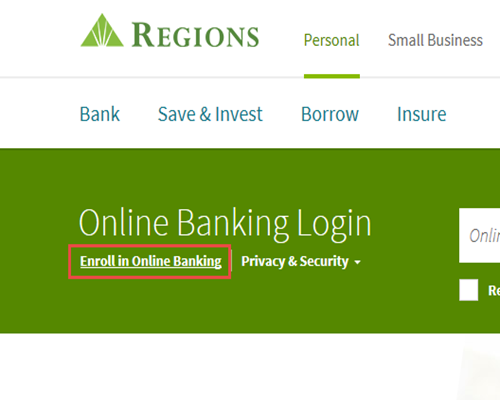

How to open an account. How to open a bank account for a minor. That account can be a plain vanilla joint account or an account designed for the under 18 crowd. Just make sure to have your information handy as the account custodian as well as the minor s information as well including social security number.

That s why kids savings accounts are available both online and in person at capital one locations so that you can bank on your schedule. Whether it s an account at a mutual fund company like vanguard a brokerage like td ameritrade or a savings account at a company like ally bank or cit bank all you have to do is choose the account type of a custodial account or ugma utma account when signing up. When the child turns the appropriate age 18 or 13 if you convert it to a checking account you can go to the bank and remove your name. Walking into a branch office is a good way to help your child become familiar with routine transactions involving his or her account.

Visit your nearby capital one location to open your kids savings account and get started with awesome free digital tools and a top rated mobile app to help them manage their money anytime almost anywhere. Most accounts marketed as bank accounts for kids come in the form of joint accounts although they go by different names. Online or in person access. Upon enrollment we will round up your mastercard or visa debit card purchases to the nearest dollar and transfer the difference from your checking account to your bank of america savings account.

Some states allow minors to open bank accounts without adult supervision but these laws vary from. The online only bank makes it easy for parents and their teenagers to track spending habits and work toward savings goals. Simply open an account with at least one adult as an account holder. Setting up the account children under the age of 18 are not legally allowed to sign documents.

Automatic or pre authorized transfers telephone transfers online and mobile banking transfers or payments or if. Some banks offer fun incentives and provide online education tools for kids. Each account must have an adult co owner.